When it comes to managing orders and transactions in the financial world, two systems often come up for discussion: OMS and EMS. Understanding the differences and similarities between these two systems can help you make informed decisions about how to manage your trading and investment activities. Let’s delve into a detailed comparison of OMS and EMS from various dimensions.

Order Management System (OMS)

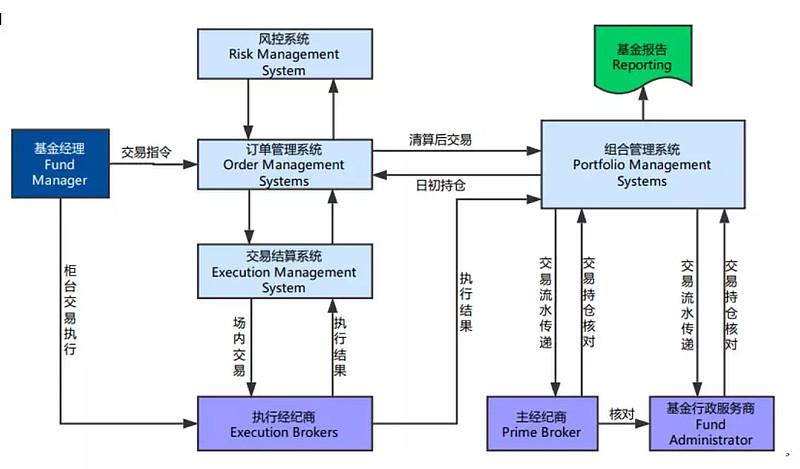

OMS, or Order Management System, is a tool designed to manage positions, create orders in multiple ways, and perform order compliance checks to ensure users receive constraints when creating orders. In terms of transaction management, OMS provides trading portfolios, trading instructions, FIX connections to execution targets, algorithmic trading options, account allocation, and reminders from brokers and dealers at the end of the day.

Here are some key features of OMS:

| Feature | Description |

|---|---|

| Trading Portfolios | OMS allows users to manage and track their trading portfolios. |

| Trading Instructions | Users can create and manage trading instructions through OMS. |

| FIX Connections | OMS provides connections to execution targets using the FIX protocol. |

| Algorithmic Trading Options | OMS supports algorithmic trading, allowing users to automate their trading strategies. |

| Account Allocation | OMS helps users allocate their accounts efficiently. |

| End-of-Day Reminders | OMS sends reminders to users about their trading activities at the end of the day. |

Execution Management System (EMS)

EMS, or Execution Management System, is a system designed for execution and customization. Its primary goal is speed, volume, and data analysis. This software does not focus on creating and maintaining asset portfolio models and balanced accounts. If you are an active trader, a hedge fund, or a long-term asset manager who is concerned about achieving the best price for large orders rather than a series of allocations for each account, then EMS is the right system for you. EMS also provides real-time price quotes and has the ability to execute more advanced transactions across brokers. One unique feature of EMS is its ability to provide traders with the ability to customize specific trading algorithms. If you want to execute a portion of a trade group for price discovery and then execute the remaining trades, EMS is what you need.

Here are some key features of EMS:

| Feature | Description |

|---|---|

| Speed | EMS is designed for fast execution of trades. |

| Volume | EMS can handle large volumes of trades. |

| Data Analysis | EMS provides advanced data analysis tools for traders. |

| Real-Time Price Quotes | EMS offers real-time price quotes to traders. |

| Customizable Algorithms | EMS allows traders to customize specific trading algorithms. |

| Direct Market Access (DMA) | EMS supports DMA, allowing traders to execute trades directly on the market. |

Comparison of OMS and EMS

Now that we have a basic understanding of OMS and EMS, let’s compare the two systems in terms of their features, strengths, and weaknesses.

Features:

- OMS focuses on order management and trading portfolios, while EMS is designed for execution and customization.

- OMS provides a range of tools for managing trading portfolios, while EMS offers advanced data analysis and real-time price quotes.

- EMS allows traders to customize specific trading algorithms, while OMS focuses on order management and compliance.

Strengths: